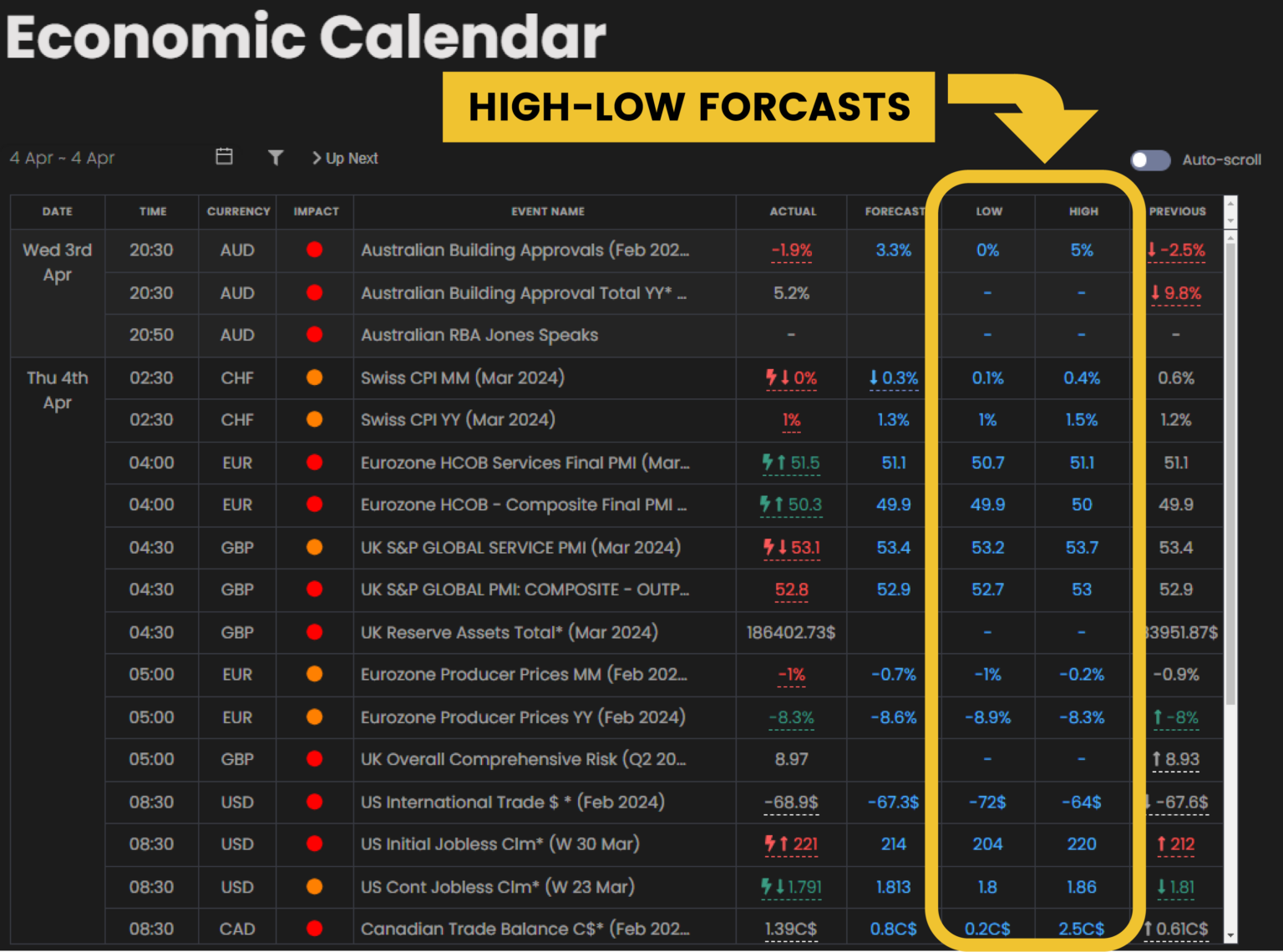

Secret #1: Powerful Institutional “High-Low” Forecasts vs Unhelpful Retail Forecasts

Everytime there is a major economic data release a number of credible institutions are surveyed to give their best estimate on what the economic data point will be.

This is called the “forecast.”

Retail calendars then take the middle number of that estimation. This becomes the “forecast” number in their economic calendars.

However this number is quite unhelpful. Read on and you’ll see why.